M&A Knowledge Base

Mergers and acquisitions (M&A) can be a meaningful part of the founder journey: Whether you're thinking about selling your company, acquiring another, or just preparing for future possibilities. For SaaS founders, understanding M&A means learning how buyers think, what makes a company attractive, and how to navigate the process from initial conversations to close.

Learn the fundamentals: timing, valuation, deal structures, due diligence, and how to position your business for a smooth and successful exit. Even if you're not planning to sell soon, being M&A-ready puts you in a stronger position long-term.

M&A Playbook

Learn the key concepts SaaS founders need to understand about mergers and acquisitions, whether you're actively considering an exit or just planning ahead. Find out what buyers look for in an acquisition, how to position your company for a strategic sale, and the typical steps involved in the M&A process, from outreach and LOIs to diligence and deal structure. You'll also hear insights on timing, valuation, and how to think about optionality. It’s a practical, founder-first overview of how to navigate M&A with confidence, even if you're years away from a transaction.

Expert Session Recordings

In this conversation, Noah Tucker, founder of the acquired startup Social Snowball, will share behind-the-scenes strategies and pivotal moments from his journey to build a valuable, acquisition-ready company.

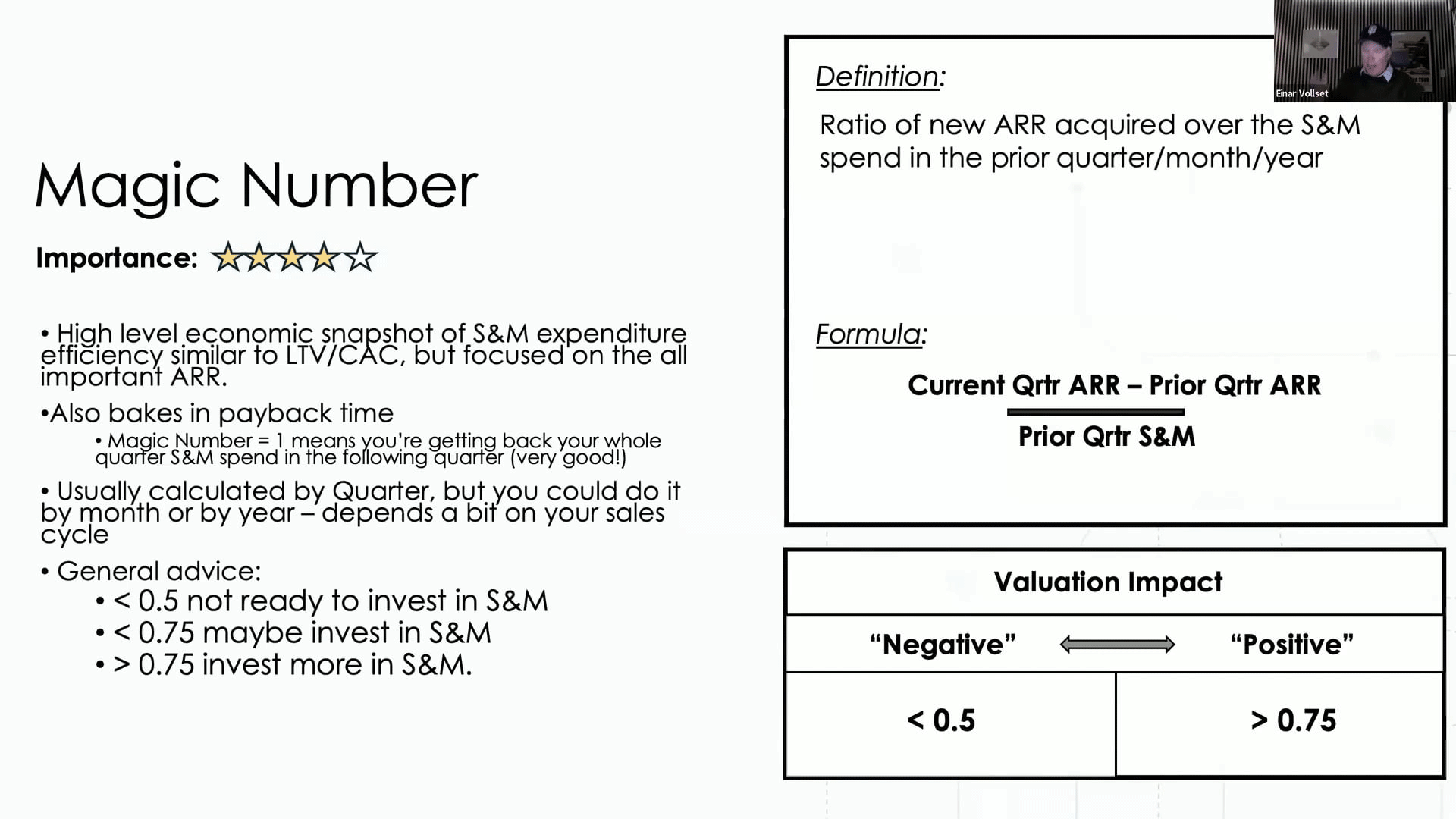

Einar Vollset, co-founder of TinySeed and Discretion Capital, breaks down what buyers really look for when acquiring B2B SaaS companies. He covers the metrics that drive valuation—like ARR growth, NRR, EBITDA margin, and customer concentration—and highlights how factors such as business model, market focus, and team structure influence buyer interest. Whether you're exploring an exit or just want to build a more valuable business, this is a deep dive into what makes SaaS companies sellable.

In this live interview, we chat with Kevin Wagstaff, co-founder of Spectora, the bootstrapped SaaS that scaled to $15M ARR before bringing on a CEO and selling a portion to private equity. We’ll cover how he grew the business, what the exit process looked like, and lessons learned along the way.

good links

B2B SaaS M&A Firm

M&A firm owned by TinySeed co-founder, Einar Vollset.

.jpeg)

.jpeg)